Request Information

Loading…

Why Cornerstone University?

At Cornerstone University, enter an experience of relational learning and discover all that Christ has for your life. Online or on campus, there’s an atmosphere that inspires your intellect and strives to ensure your success. Explore academic excellence, uncompromising values and training that prepares you to boldly enter the workforce.

Bold. Christ-centered. Influential. This is Cornerstone University.

94%

Job placement rate for those prepared to lead in their careers.

90

Four-year and accelerated programs.

94%

Of alumni believe that their education prepared them for the demands of their careers.

A Focus on Business

Undergraduate and Graduate degrees challenge and prepare you to become a faithful business leader. Leading professors with real-world experience will come alongside to help you achieve academic and professional excellence.

Computer Science & Engineering

The world needs curious, logical minds with a bent toward innovative problem-solving. Cornerstone helps build a firm foundation for today's challenging job market in the fields of computer science, engineering and mathematics.

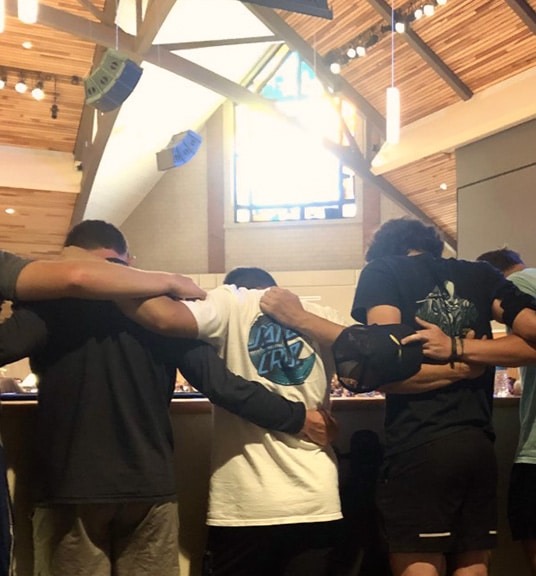

Ministry and Theology

Come experience a multidenominational atmosphere, where accredited course work helps refine and define your calling. Undergraduate and graduate programs expose you to leadership essentials, and sound Biblical theology.

Science & Kinesiology

Nursing, pre-med, pre-pharmacy, pre-physician's assistant and so many more...all degrees in strong demand in the expanding health services industry. At Cornerstone your faith and education helps prepare you to fulfill your calling.

Education

Pursue your calling to be a school teacher, music educator, or focus on TESOL: Teaching English as a Second Language. Graduate and postgraduate degrees available.

Psychology & Social Sciences

Mental health fields become increasingly important. A bachelors from Cornerstone University challenges you to put your studies and faith into practice.

Foundation and Values

With an unwavering Biblical worldview of life, knowledge, wisdom and community, Cornerstone’s Confession and Foundational value statements reflect our commitments to courageously live lives that are bold, Christ-centered, and influential.